Clientele Hospital Plan Claim Forms – An ERISA Portion 502(a) plan may be claimed in a number of approaches. Both for medical and dental solutions, claims kinds are offered. Your medical provider will need you to full and publish these assert papers to UnitedHealthcare. To save you time, declare types can easily be bought within the office buildings of many taking part companies. Following finishing the form, you could possibly send out it right to UnitedHealthcare. Visit your health insurance representative or contact UnitedHealthcare if you need help filling out your form.

Claim Type for ERISA Section 502(a) Strategies

A specific amount of time must move well before posting an ERISA Area 502(a) plan state type. In this length of time, a fiduciary duty declare or benefit denial assert needs to be made. Federal and state legal guidelines manage ERISA segment 502(a) promises.

If you don’t adhere to this timeline, the EBSA will levy a civil fine on you. The civil great is calculated like a proportion of your plan’s disgorged losses and profits. The fiduciaries, who are responsible for paying the okay, can be kept accountable for it.

Review the claim form to make sure it complies with ERISA regulations if you have a plan that does. A place exclusion provision might be a part of a plan. Inside your SPD as well as in your communications with participants, be sure to mention the area restriction. However, you should refrain from saying anything unnecessarily since it can be used against you in court. In any occasion, ensure that you speak with the legal advice for your personal want to ensure compliance.

5 percent of the sum at concern is the punishment quantity. If you miss the payment deadline, you may, however, ask for a penalty waiver. If a fine is excessively high, it is not waived. If you can pay it, you should pay the penalty. It ought to be paid inside of two months. If you miss the deadline, the EBSA will issue a revised penalty notice.

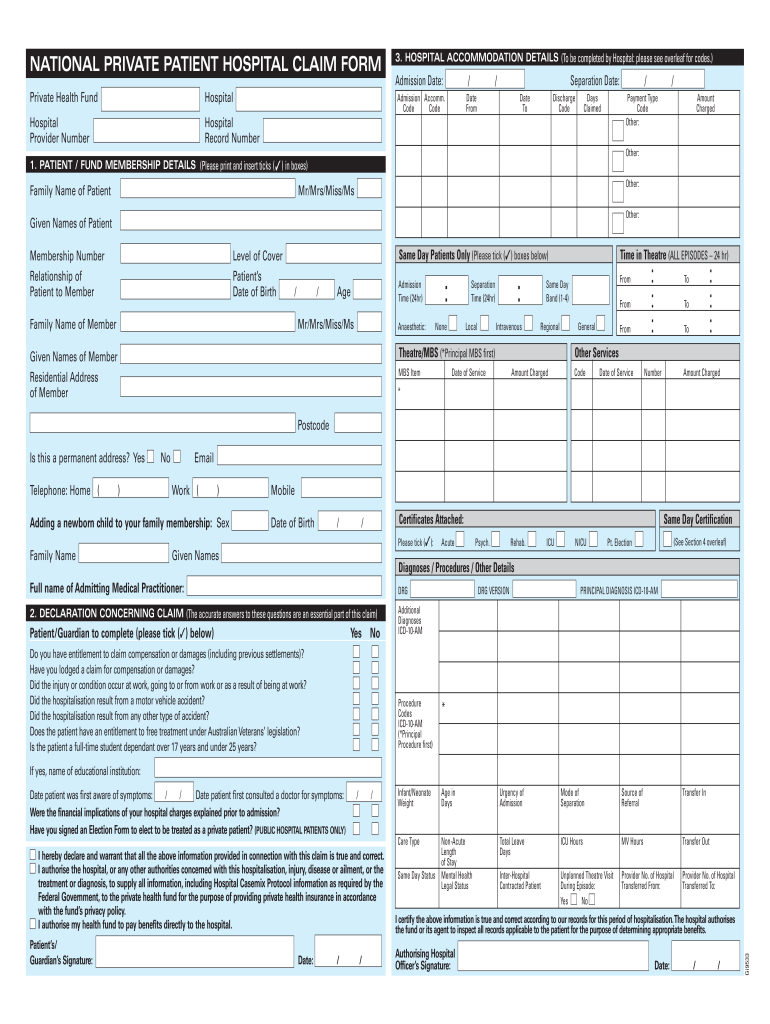

Type for medical care promises

You should involve all needed details when submitting a health-related providers claim. For instance, you need to add the service’s some time and location. You must also attach documentation of travel if you are filing a claim from outside the country. It is possible to require the help of your state of health treatment provider’s payment department. In order to record all medical costs, section D must also be completed.

UnitedHealthcare will give you the assert kind towards the medical professional. It needs to be recently and accurately filled out. To take the settlement, the supplier must have a present Taxation Recognition Number. The form is also accessible in the provider’s office. For the insurance company to directly spend the money for service provider, you must be sure that there is a current Tax Detection Amount.

Lots of the cases for this type can also be located on the CMS-1500 kind. It need to consist of particulars on the person, the professional, the course of treatment method, as well as other appropriate info. It’s crucial to adhere to the insurance provider’s guidelines in order to minimize increase and errors your chances of getting paid. It is preferable if you provide more details. For instance, you should note on the form if the patient was engaged in a car accident.

Fill out a CMS-1500 if you need to file a claim for medical services. In order for it to be recognized, it has to have all essential information concerning the wounded celebration. A duplicate of your completed kind needs to be provided to the patient, the patient’s authorized professional, the worker’s reimbursement insurance company, the employer or personal-covered by insurance employer, along with the company. The Workers’ Payment Table kind has become replaced with the CMS-1500.

assert type to get a dental strategy

If the entire fee is not covered by insurance in New York, the dentist may report it on a Dental Plan Claim Form. Unless the individual gets a lower price through the insurance firm, the dental practitioner will fee the patient the complete fee up front. If the patient has a secondary insurance plan and no dental insurance, the dentist can only report the fee that is not covered by the insurance plan.

A compensation claim kind for a dentistry plan includes a few aspects. The very first is to the policyholder and possesses thename and address, and birthdate from the protected fellow member. Before approving a claim, the dental plan must answer the questions in the second part. The patient’s job and academic track record, together with other specifics that will support the insurance company in digesting the state, are detailed within the next aspect.