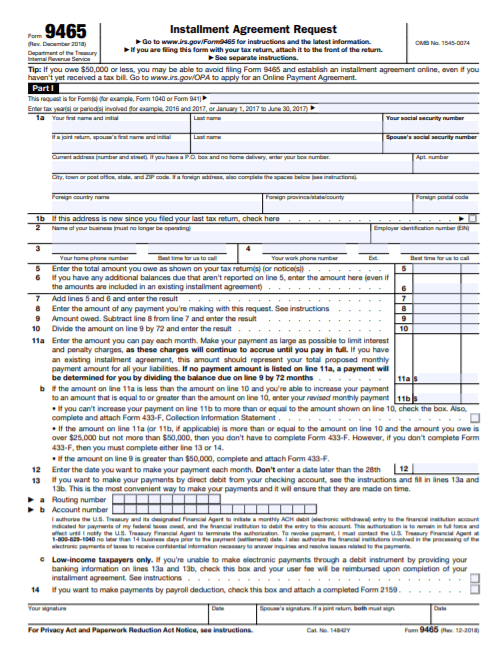

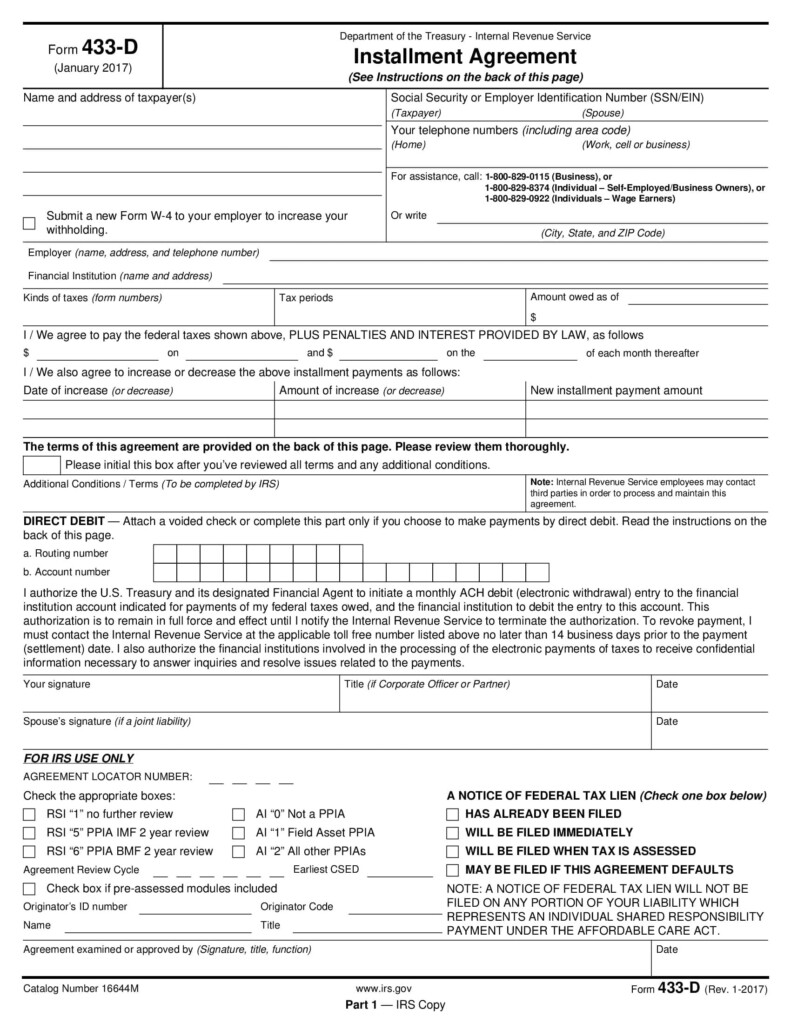

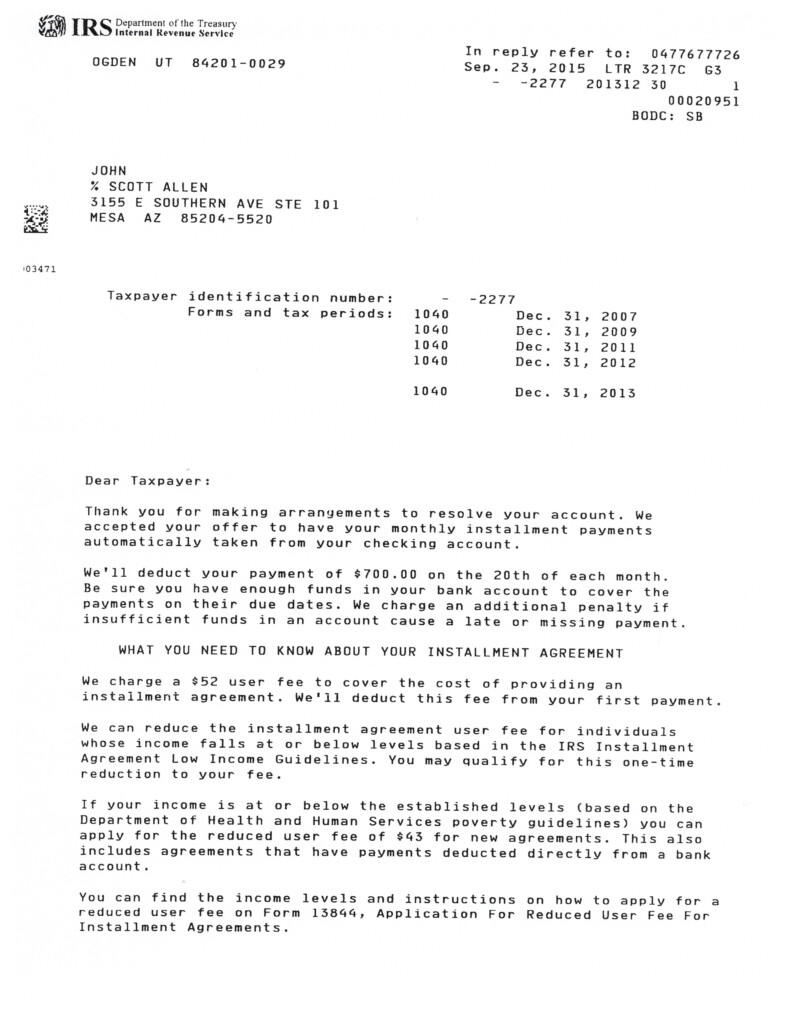

Irs Payment Plan Set Up Form – You possibly can make a payment schedule for your month-to-month installments making use of the Repayment Schedule Type. It is possible to customize the form simply by entering your contact information along with the full for each payment. You can decide whether you want the due date and sum of each payment printed. Alternatively, whether you want a coupon book for each payment. This will make it easier to handle repayments.

Alternatives for transaction plans

There are numerous of choices for you to pick from when filling in your repayment schedule develop. So that you can pick the best selection for you, you’ll need to find out how much every option expenses. As an illustration, neither of them your settlement due on Dec 14 neither your transaction expected on July 28 will be paid by the 3-Settlement Choice.

ACH Authorization That Recurs

A Repeating ACH Authorization on Settlement Plans Type enables a lender to frequently take away persistent payments coming from a customer’s checking account. The client’s bank account is going to be quickly subtracted for these monthly payments with the summary of each payment period and on persistent days. This kind of repayment is really a functional strategy to pay out recurring bills. Before to the date of the subsequent payment, it’s crucial to remember that you cannot stop an ACH payment until at least 15 days.

You must already be in contact with the consumer in order to collect ACH payments over the phone. Because of this they have to have both signed a formal contract or produced at least two acquisitions on your part in the previous 2 yrs. Before debiting the account, you must additionally collect and authenticate the ACH form. Have a duplicate of the ACH kind as proof authorization after you have gathered it.

The Authorization develop is also available for acquire in Adobe Pdf file and Microsoft Word (.docx) formats. You have to fill it up out with the complete brand of your buyer, the label of your shop, and the withdrawal amount. A outline of the withdrawals and their frequency must also be joined.

Acknowledgment from a Notary

A notary public and the signer must both properly sign the Notary Acknowledgment for Payment Program Form before it can be submitted. It ought to be approved by a fully developed mature who is capable of doing accomplishing this beneath oath. When putting your signature on, the signer need to elevate his or her right-hand. The genuineness from the unique should also be confirmed with the notary. An announcement in the signer’s identification also needs to be contained in this record.

Acknowledgments from notaries work as sworn declarations that attest to the identification from the signer. Files connected with dollars or another beneficial assets generally need them. The signer is required to actually can come before the notary and affirm they are the signer in the file.

You may use a notary-approved alternative form for this purpose if you are not a notary. Numerous technological innovation choices for notarization have received approval in the Office of Status.

Circumstances for sending a repayment schedule require

If you have trouble keeping up with your regular payments, you might want to think about asking for a payment plan. You may spread your payments over a longer period of time by using a payment plan. Installment agreements are yet another good name for repayment schedule deals. They come with a lot of responsibilities for the debtor, including supplementary interest, charges for administration, and potential audit responsibilities.