Form To Set Up Payment Plan With Nebraska Revenue – You possibly can make a payment schedule for your month-to-month installments making use of the Payment Plan Kind. You can individualize the shape by entering your contact details and also the complete of each transaction. You can decide whether you want the due date and sum of each payment printed. Alternatively, whether you want a coupon book for each payment. This will make it much easier to control obligations.

Options for payment ideas

There are many of alternate options for you to select from when filling in your repayment schedule form. To be able to choose the best selection for you, you’ll need to know just how much every single option costs. As an example, neither of the two your settlement thanks on December 14 neither your payment because of on July 28 is going to be protected by the 3-Settlement Alternative.

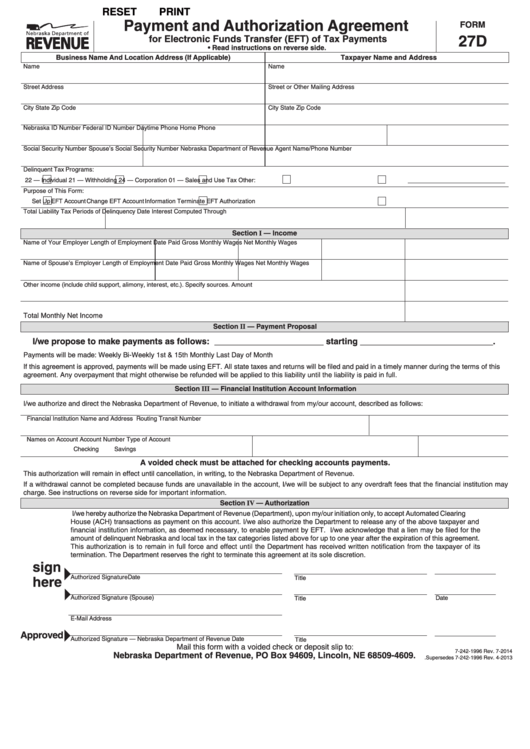

ACH Authorization That Recurs

A Persistent ACH Authorization on Payment Ideas Kind enables a creditor to regularly pull away recurring payments from a customer’s bank account. The client’s bank account is going to be quickly deducted for these particular obligations on the conclusion of each invoicing period and also on persistent days. This sort of transaction is a sensible procedure for spend persistent expenses. Before to the date of the subsequent payment, it’s crucial to remember that you cannot stop an ACH payment until at least 15 days.

In order to collect ACH payments over the phone, you must already be in contact with the consumer. Which means that they have to have both agreed upon a proper deal or created no less than two transactions of your stuff in the earlier 2 yrs. Before debiting the account, you must additionally collect and authenticate the ACH form. Have a copy of the ACH develop as proof of authorization once you have accumulated it.

The Authorization kind is also accessible for acquire in Adobe PDF and Microsoft Phrase (.docx) formats. You must fill it by helping cover their the total label of the buyer, the name from the merchant, along with the drawback quantity. A description of the withdrawals in addition to their frequency should also be came into.

Acknowledgment from a Notary

A notary public and the signer must both properly sign the Notary Acknowledgment for Payment Program Form before it can be submitted. It ought to be authorized with a adult grownup who is capable of doing the process below oath. When putting your signature on, the signer need to elevate his or her right-hand. The credibility from the signature should also be established through the notary. An announcement in the signer’s recognition also needs to be included in this record.

Acknowledgments from notaries function as sworn declarations that verify the identity in the signer. Documents involving dollars or other useful assets typically require them. The signer must individually appear ahead of the notary and affirm they are the signer from the document.

You may use a notary-approved alternative form for this purpose if you are not a notary. Many technological innovation selections for notarization have obtained endorsement from your Section of State.

Conditions for submitting a repayment schedule ask for

You might want to think about asking for a payment plan if you have trouble keeping up with your regular payments. You are able to spread out your instalments over a for a longer time length of time by using a repayment plan. Installment deals are an additional reputation for payment plan deals. They come with a lot of responsibilities for the debtor, including supplementary interest, charges for administration, and potential audit responsibilities.