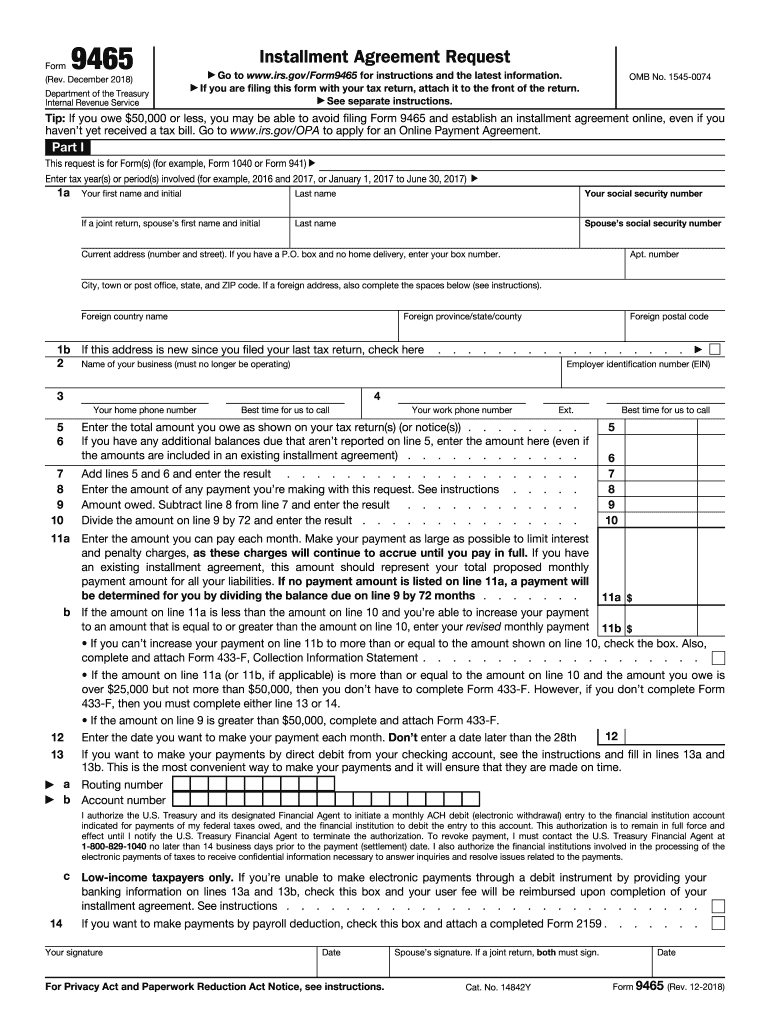

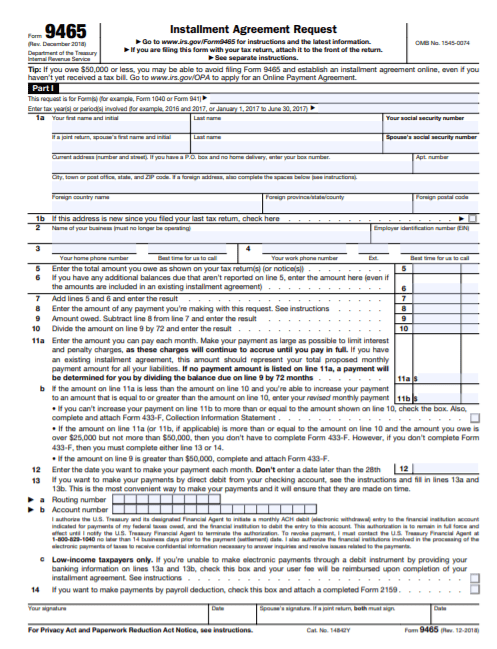

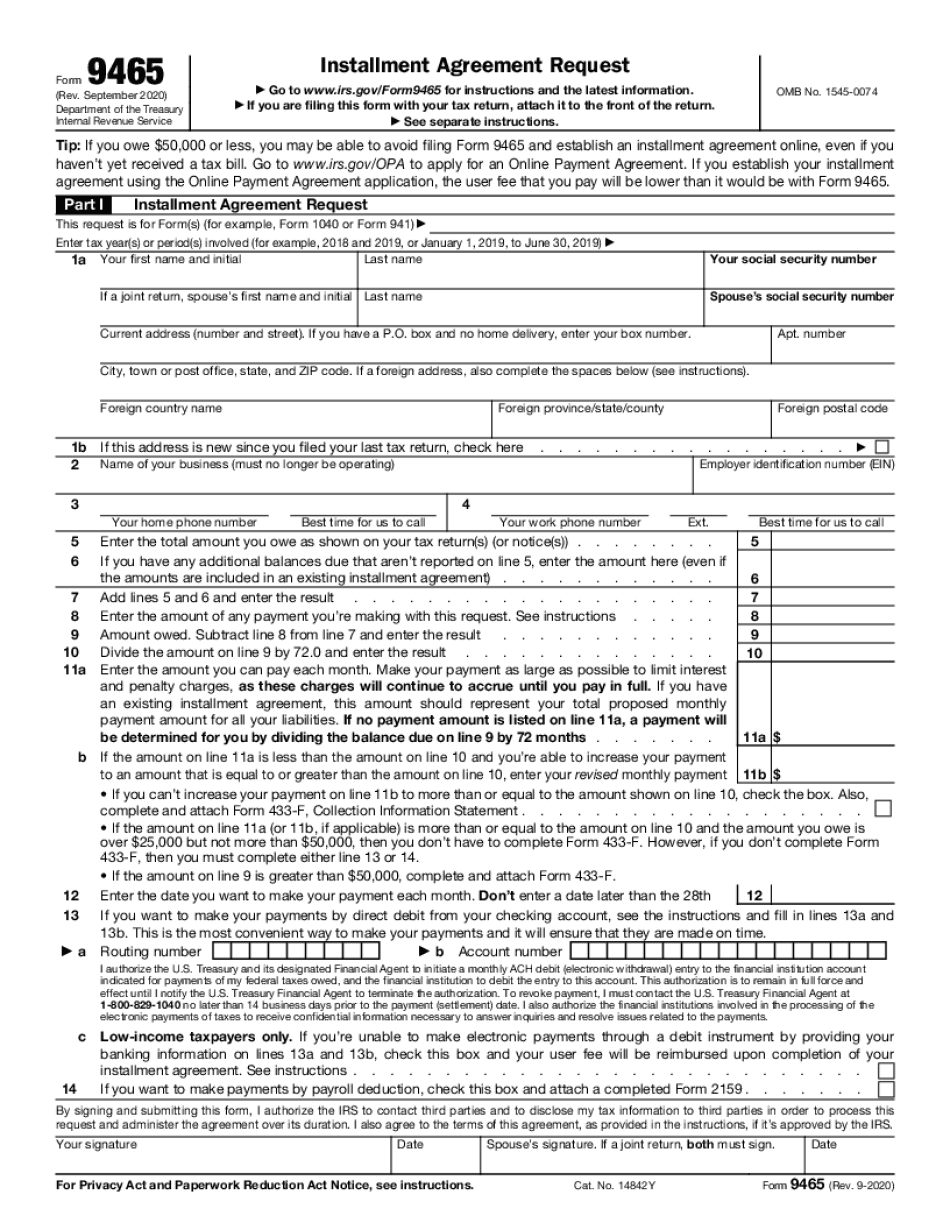

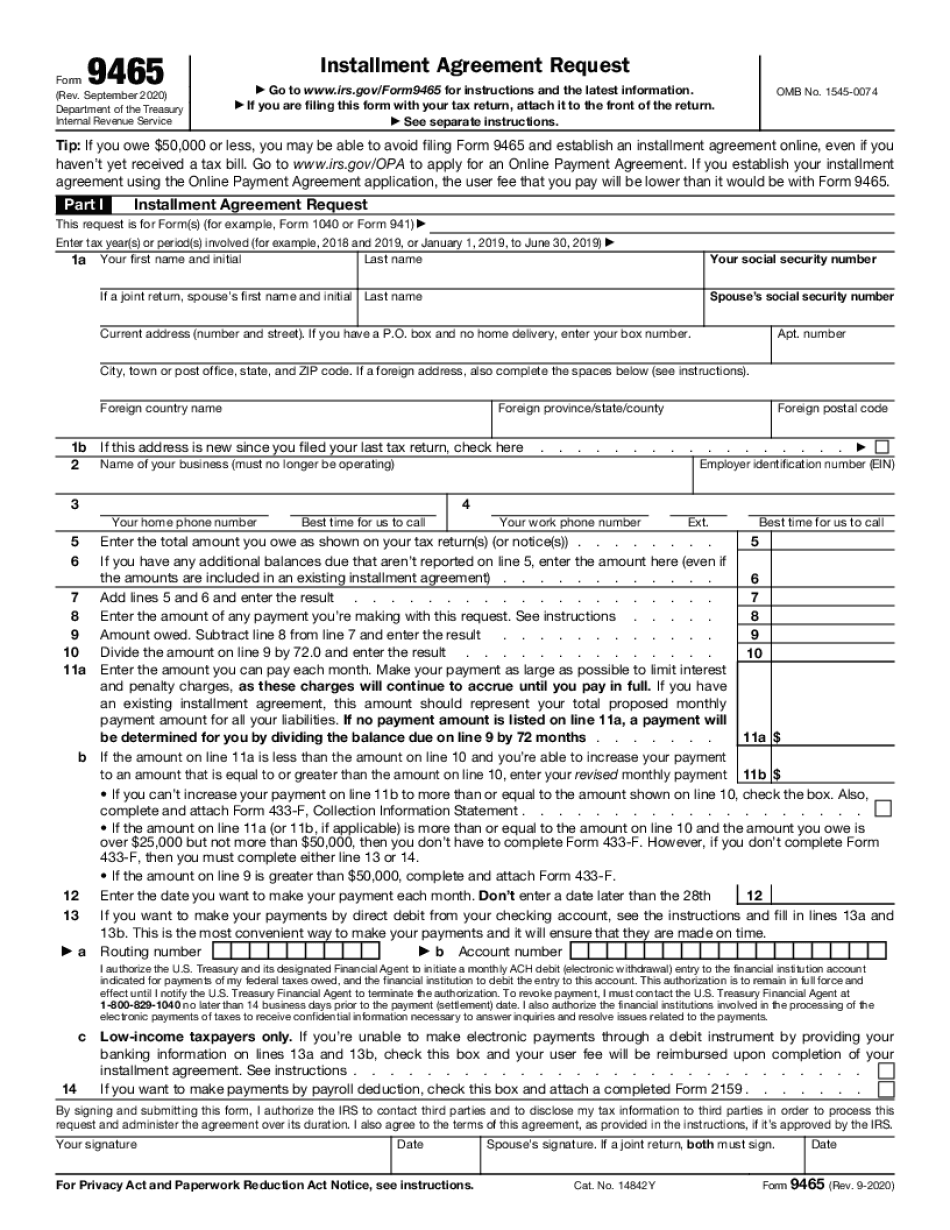

Income Tax Payment Plan Form

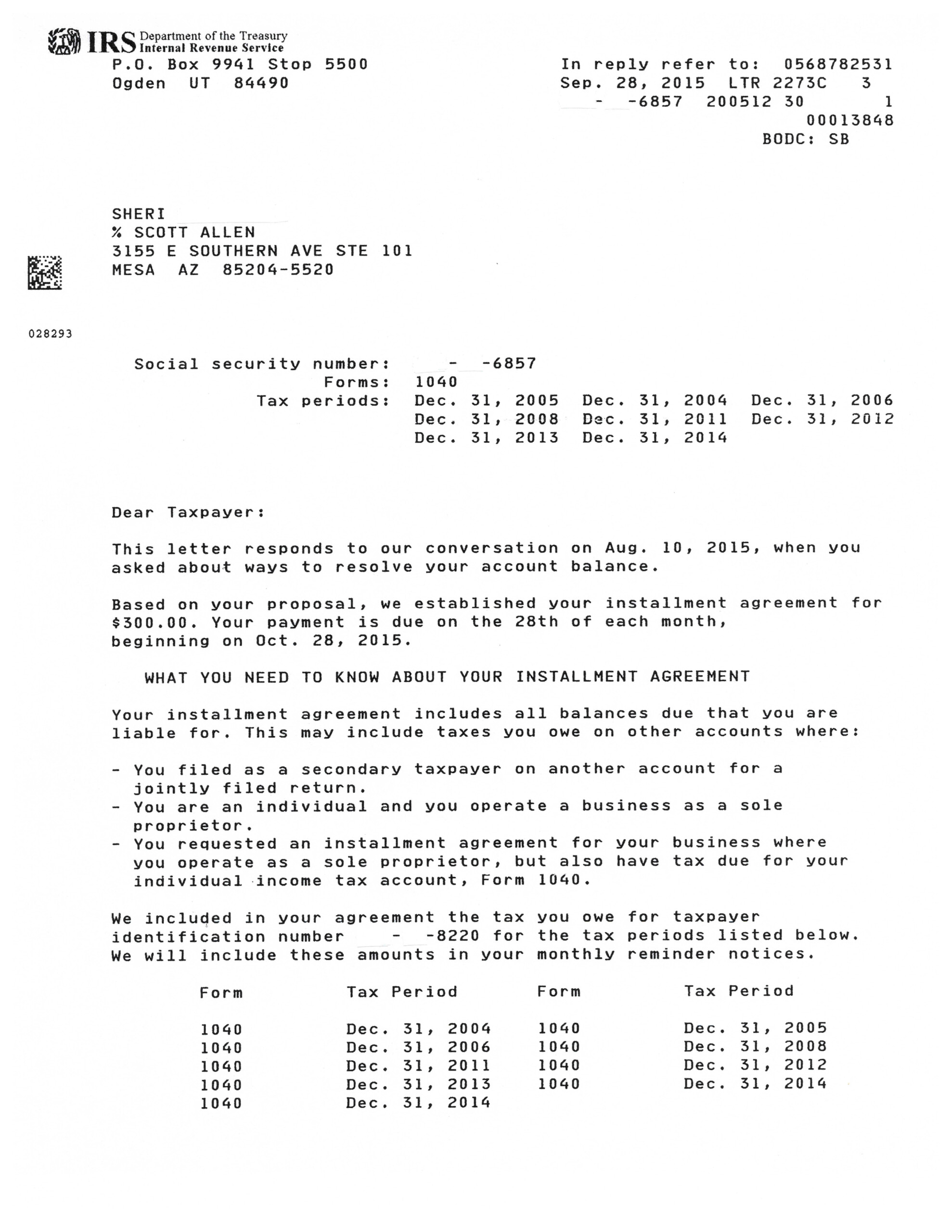

Income Tax Payment Plan Form – You possibly can make a transaction agenda for your month to month installments utilizing the Repayment Schedule Develop. It is possible to individualize the shape simply by entering your contact info as well as the total for each settlement. You can decide whether you want the due sum and … Read more