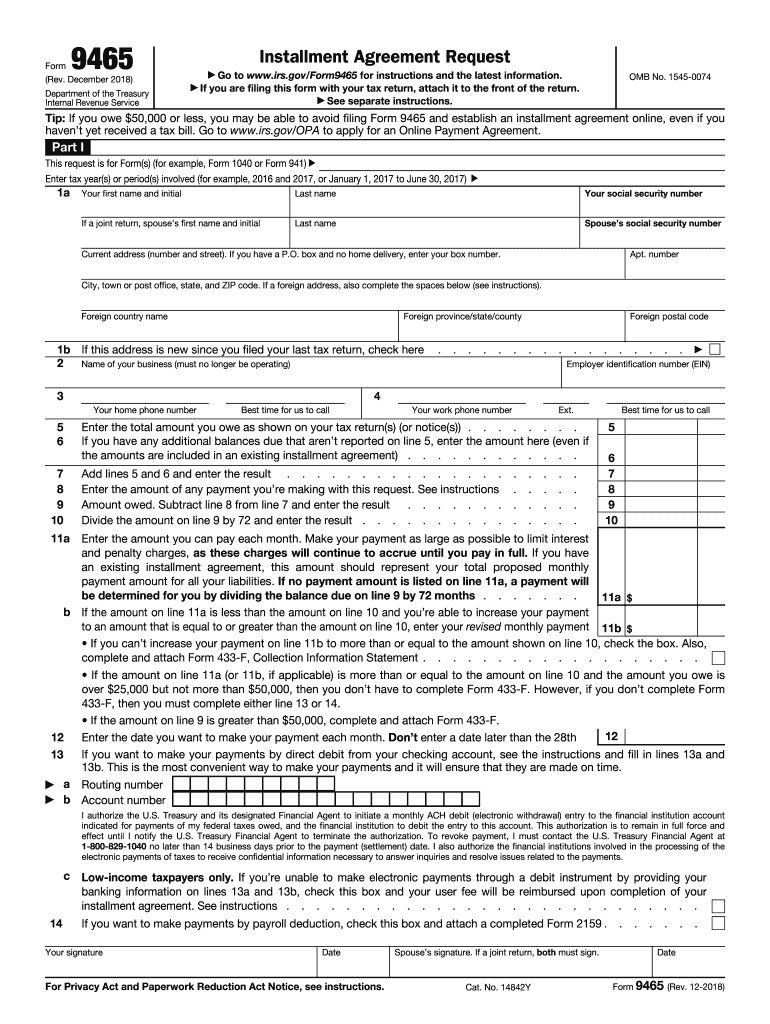

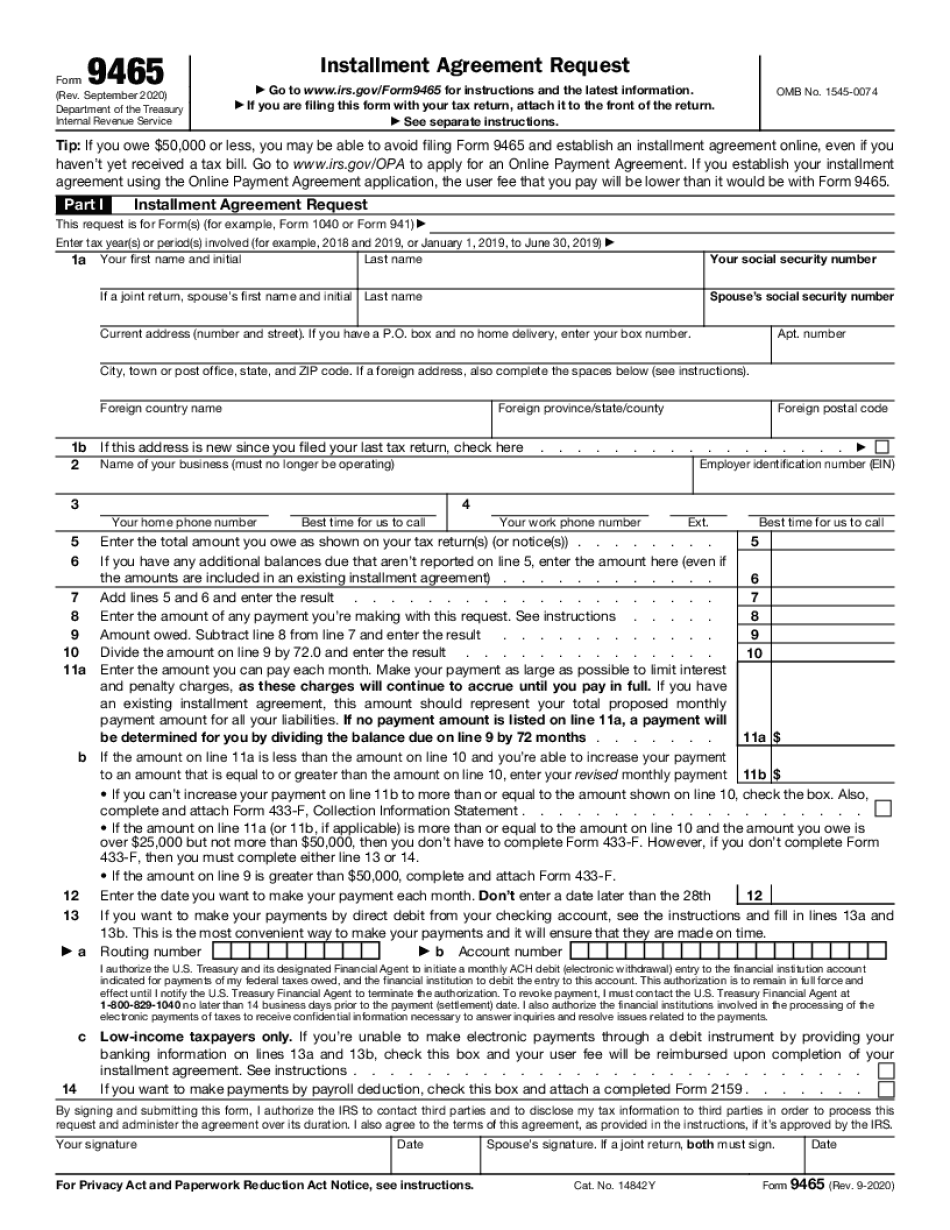

Irs Payment Plan Form

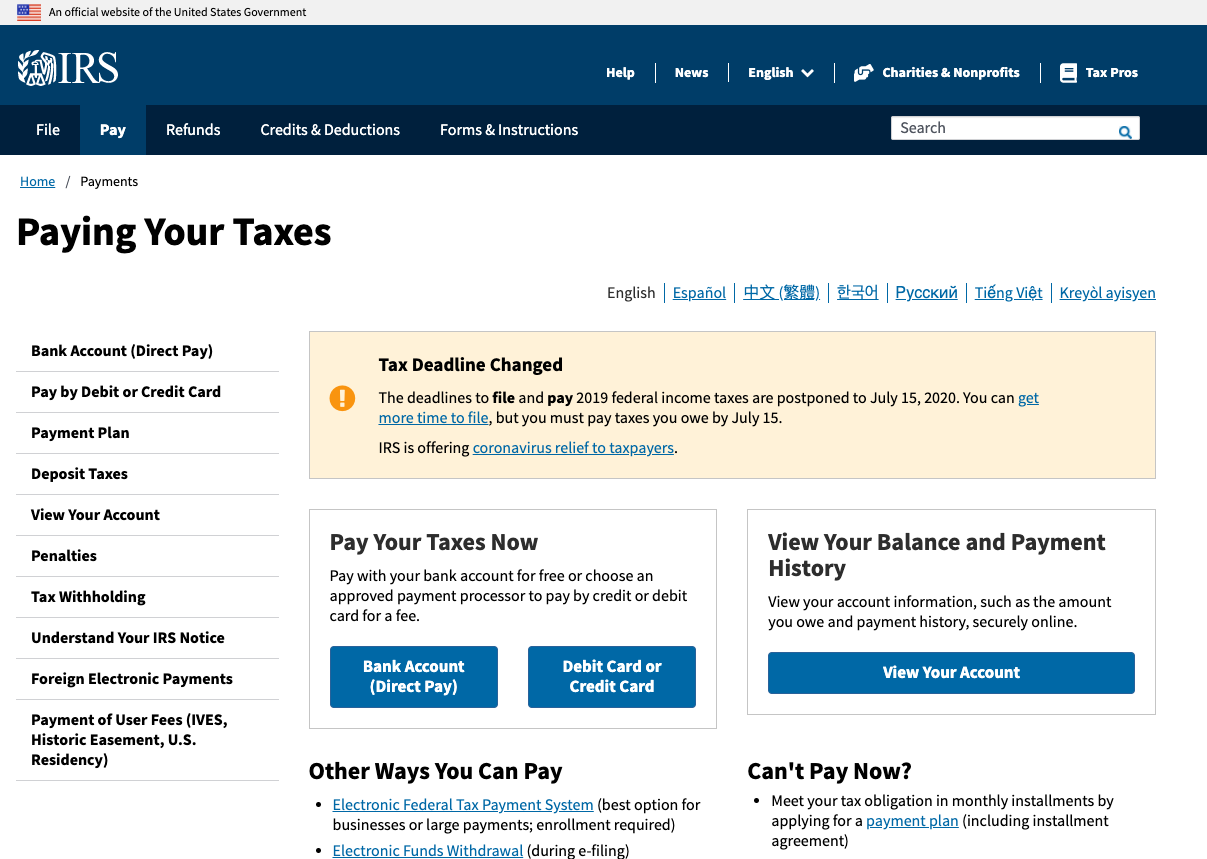

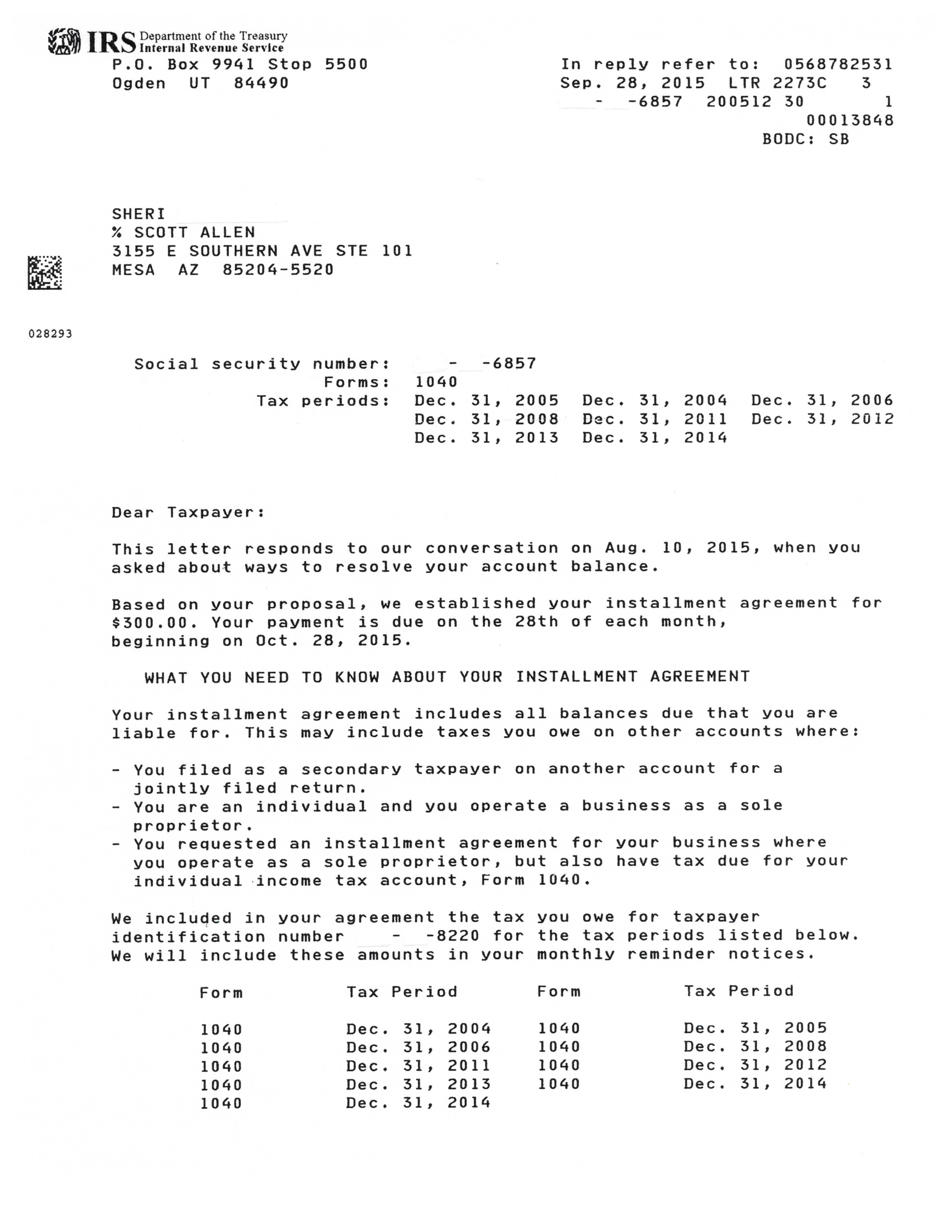

Irs Payment Plan Form – You may make a payment agenda for your regular monthly installments utilizing the Repayment Schedule Type. You are able to personalize the shape by entering your contact info and the complete of every settlement. You can decide whether you want the due date and sum of each payment printed, or … Read more